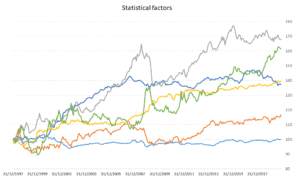

Statistical factor models

Statistical factor models are used by investment professionals to model asset returns. They are one of three kinds of factors models. The two other models are macroeconomic factor models and fundamental factor models.

Interestingly, statistical factor models are both easier and more difficult to apply than the other two types of models, for different reasons. On the one hand, far less data is needed to estimate a statistical factor model. This makes it very easy to collect the necessary data. On the other hand, the statistical methods themselves are somewhat more difficult to implement, at least using a simple spreadsheet. This means it is hard to create a statistical factor model example without using software such as Python or MATLAB.

On this page, we provide a primer on statistical factor models and discuss the methods professional use to estimate statistical factor models.

Statistical factor model types

There are two primary methods that are used to create statistical factors models. Theses methods are factor analysis and principal component analysis. In factor analysis, factors are portfolios that explain the covariance in asset returns. In principal component models, the factors are portfolios that explain the variance in asset returns.

Advantages and disadvantages

The main advantage of statistical models is that we only need data on the assets’ prices. From these prices we calculate returns which we can use to estimate the statistical model. This is very different from macroeconomic and fundamental factor models, where we need to collect a lot of macroeconomic data and fundamental data, respectively.

The main disadvantage of statistical models for asset returns is that these models do not lend themselves well to economic interpretation. Thus, it is not possible to interpret the underlying drivers of the statistical factors.

Summary

We discussed statistical factor models in finance that used to model asset returns. These factors are generally hard to interpret but require only little data to estimate.