Average Daily Volume (ADV)

The average daily volume (ADV) or average daily trading volume equals the average number of shares traded over a certain period of time. The ADV is a very important measure that is used by investors to gauge the liquidity of a stock. We explain how to calculate the ADV and how it is used by traders and investors to make trading decisions.

Average Daily Trading Volume Calculation

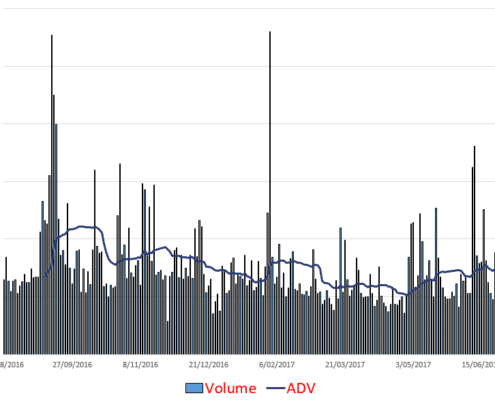

The average daily trading volume calculation is very straight forward. In particular, all we need is historical data on the daily volume (i.e. number of shares) of a security. Suppose is the daily volume at day t. Then the n-day ADV equals

In practice, the 30 day average volume is used as a proxy for a stock’s liquidity. Thus, an n equal to 22 (the number of trading days in a month) is used by most fund managers.

Average Daily Volume Interpretation

How is the ADV used by investors and traders? First, it is important to understand that ADV is a smoothed estimate of the amount of trading that happens in a security. As such, it tries to measure the average amount of trading taking place in the security under consideartion. The higher the ADV, the more liquid the security.

When investors use ADV, they will actually compare the ADV to the size of the position they want to trade. Often, a trade will be called high-touch or low-touch. A trade is considered high-touch is when the trade exceeds 5% of the daily average volume. Trades below 5% of ADV are considered low-touch.

In other words, the larger the size of the trade relative to the ADV, the more difficult it will be to trade the position. This is because larger trades impact security prices. This market impact will cause prices to go up (down) in the case of a purchase (sale). This will have an adverse impact on performance.

Average Daily Value

Another measure that is used is the average daily value traded. It is defined similarly as the average daily volume. Instead of taking the average of the trading volume of the past 30 days, we take the average of the daily volume multiplied by the closing price at the end of each day. This is equivalent to the average daily volume in dollar.

Summary

We discussed the Average Daily Volume. It is a measure used by fund managers to gauge whether or not trading a position will have a big impact on prices. The higher the ADV, the more liquid a security.

Return calculation

Want to calculate the Average Daily Volume (ADV) in Excel? Download the Excel file we used: Average Daily Volume template