Total expense ratio

The total expanse ratio is a periodical fee charged by ETFs, that represent part of the management costs attributed to a certain fund and a profit margin. In general, charged fees a much smaller than compared to other funds e.g. mutual funds, hedge funds,fund of funds and private equity funds. As explain later on, investor should thoroughly investigate the charged TER as this may impact their final wealth largely.

Importance of total expense ratio

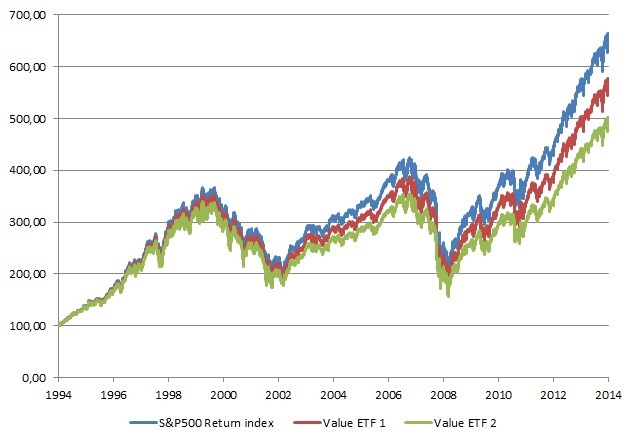

So why should investors carefully examine the total expense ratio? Simply because ETFs that charge a lower TER, will result in a higher end-result for the investor. Even though 1% on an annual basis or 2% may not sound much. In the long run, these small differences add up and result in a big difference. This is intuitively shown in the figure below and in the provided Excel spreadsheet.

What determines total expense ratio

Compared to mutual funds, the total expenses of ETFs are in general lower. The first driver of the total expense ratio is the asset class in which the ETF invests in. The TER for bond and equity ETFs are the lowest. ETFs that invest in other assets classes, such like commodities, or REITs do have higher total expense ratio. This is attributed to the higher required managerial effort and the roll over cost in case of commodities. The latter is the result of the periodically role over in futures that give exposure to commodities. A second factor that determines the heigth of the TER is the ease of invest and liquidity of the underlying. Investments in the S&P500, Nasdaq, or the German DAX index are easy to do so. Investments in emerging market, illiquid stocks are much harder and more costly. Therefore, the ETFs devoted to less liquid and more exotic regions charge a somewhat higher fee. A third factor that determines the TER is the investment style. True passive ETFs charge a low fee, investment style ETFs e.g. minimum volatility, high dividend yield etc.charge higher fees.

Summary

The total expense ratio equals the total cost investors bear on a yearly basis by investing in an ETF. The higher the TER, the lower the total return for the investor is. ETFs investing in illiquid stocks, applying a certain strategy, apply hedging or invest in more exotic regions typically charge higher fees.

Total expense ratio

Need to have more insights? Download our free excel file: TER.