Present Value of Growth Opportunities (PVGO)

The net Present Value of Growth Opportunities (PVGO) captures the fact that firms may have investment opportunities that will generate a rate of return that is higher than the required rate of return. If that is the case, the company should not pay out all earnings as dividends. Instead, it should invest the earnings in profitable projects. These investment projects will increase the overall value of the company. The PVGO equals the present value of the value added by the company by pursuing these opportunities.

We discuss the formula that should be used to calculate the PVGO as well as a present value of growth opportunities calculator in Excel. The Excel spreadsheet can be downloaded at the bottom of the page.

Present Value of Growth Opportunities formula

We can decompose the fundamental value of a company that has growth opportunities into two components. On the one hand, we have the present value of future dividends. On the other hand, we have the PVGO. Using a formula

Clearly, the value of the company consists of two components:

- The value of its assets in place (E1/r), which is the present value of a perpetuity

- The present value of its future investment opportunities

As the reader may expect, a large component of growth companies’ share price reflects investors’ expectations of future growth. Thus, growth companies tend to have high PVGO.

Can the present value of growth opportunities be negative? Yes, a negative present value of growth opportunities implies that the company should not pursue any of the projects it is considering. Instead, it should distribute all the earnings to the shareholders.

PVGO example

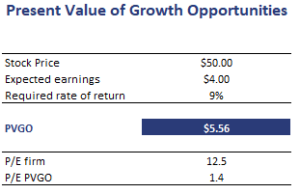

Next, let’s calculate PVGO using the current stock price and earnings per share. The following table illustrates the necessary calculations. We can also decompose the P/E ratio of the company into the part that due to dividends and the part that results from the PVGO.

Summary

We discussed the net PVGO. This method is useful to analyze the market-implied growth opportunities of a company.

PVGO calculator

Want to have an implementation in Excel? Download the Excel file: PVGO