Variance drag

Variance drag, also called volatility drain, is best described as the value which an underlying security (ETF) loses as a result of (high) market volatility. In simple terms, this means that even when the market moves sideways and has no return at all over a certain period of time, the portfolio could still have lost a significant part of its value. Under high volatility, the portfolio’s could yield a negative return even when the market has moved upwards. As a results of this leakage, it may be ill-advised to hold this kind of investment for longer periods.

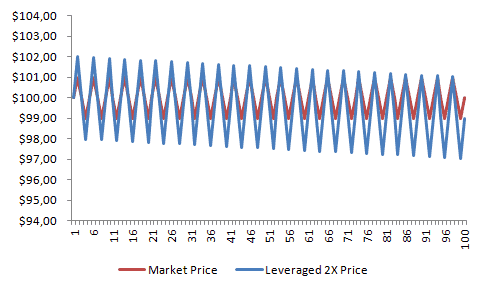

Leveraged ETF variance drag

Leveraged ETFs provide a multiple of the daily return of the underlying, often a broad index, they track. Specifically, such kind of ETFs, provide 2 or 3 times the daily return of the underlying index. This means that if the market goes up by 1%, the tracker goes up by 2% for the 2x leveraged, and 3% for the 3x leveraged ETF. If the market goes does down by 1% the same return is multiple by the multiple of the ETF: -2% or -3%. Due to return accumulation over time, these kind of ETFs are exposed to variance drag. This drop becomes even more pronounces the larger the leverage of the ETF is. An example of this behaviour is shown in the Excel sheet provided below.

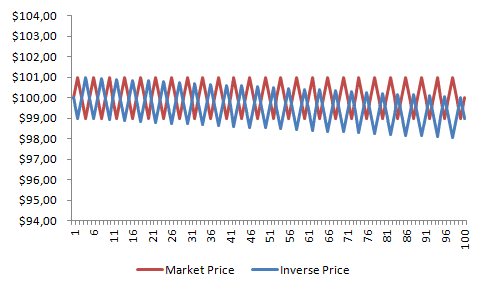

Inverse ETF variance drag

In contrast to what you could expect, even inverse ETFs show this unfavorable behaviour. This is due to the objective of such an ETF: tracking the inverse of the daily return. Specifically this means that, if the underlying increases by 1%, the inverse ETF decreases in value by 1% and vice versa. An example of this behaviour is shown in the Excel sheet provided below.

Summary

Before investing into financially engineered ETFs, investors should be aware off unfavorable forces. An example of this is the variance drag which negatively influences the value of the underlying security. As a result, high market volatility can result in a decline in value of the ETF, even if the underlying securities increased in value.

Variance drag

Need to have more insights? Download our free excel file: Variance Drag.