Standardized Unexpected Earnings (SUE)

Standardized unexpected Earnings (SUE) is a momentum indicator that is positively related to subsequent stock returns. A popular investment strategy based on SUE is the post earnings announcement drift trading strategy. This strategy exploits the observed phenomenon that the stock price tends to drift in the days after the earnings announcement. A strategy that buys stocks with a positive surprise and sells stocks with a negative surprise generally generates alpha.

On this page, we discuss the standardised unexpected earnings formula and definition.

Standardised unexpected earnings definition

To calculate SUE, we first have to define unexpected earnings. Unexpected earnings equal the difference between reported earnings and expected earnings. Using a formula, we can define unexpected earnings as follows

Another important aspect of unexpected earnings is the variability of analysts’ EPS forecasts. The higher the consensus among analysts, the lower the standard deviation. A high surprise when analysts were in agreement is therefore a stronger signal that the surprise was unexpected. We standardize the earnings surprise as follows

Standardised unexpected earnings interpretation

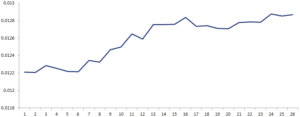

The economic rationale for using SUE is that earnings surprises are not immediately fully reflected in the stock price. That is, the price does not immediately reflect the new information completely. This implies that investors can earn excess returns by buying stocks that have positive stock surprises. This behavior of stock prices drifting upward after a positive announcement is referred to as the post-earnings announcement drift. A similar downward drift is also observed for stocks with negative surprises.

Summary

We discussed unexpected earnings or earnings surprise as a momentum indicator. Stocks with positive earnings surprises tend to drift upward following the earnings announcement. Similarly, stocks with negative earnings surprises tend to drift downward after the announcement.