Probability of an FOMC Change

Market data can be used to infer market expectations. A good example is the probability of an FOMC change. Using Fed funds futures, we can calculate the probability of an FOMC rate cut. On this page, we illustrate the approach. A spreadsheet that implements the approach is available below.

Introduction

To be able to infer the expected probabilities of upcoming Fed interest rate change, we first need to introduce some terms and definitions before we can do the analysis.

- Federal funds rate: This is the interest rate that banks and credit unions charge other deposit institutions for loans in the overnight interbank markets. The federal funds effective (FFE) rate is the weighted average of interest rates charged on overnight interbank loans

- Federal funds target rate: This is the rate set by the Federal reserve in Federal Open Market Committee (FOMC) meetings. The governors of the Federal reserve meet 8 times per year to set the rates based on the economic environment and inflation rate. This target rate is typically set in a range

We should note that the Fed does not directly control the FFE rate, but influences this rate through its monetary policy tools. The goal is to keep the FFE close to the target rate. The monetary policy tools used by the Fed are open-market operations and the interest rate paid on bank reserves.

The final piece of the puzzle before we can calculate probabilities is Fed fund futures. These contracts are traded on CME and reflect the market expectation of the FFE rate at the time of the contract maturity. The price will reflect market expectations about future changes in the Fed funds target rate. The futures can have monthly maturity dates as far out as 36 months.

Probability of a change in the Fed funds target rate

To determine the probability of a change in the Fed funds target rate, we can use the following equation

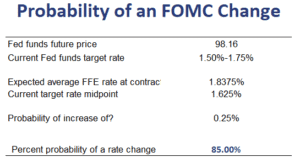

Let’s consider a numerical example. The following table implements the above approach using an Excel spreadsheet

The spreadsheet can be downloaded at the bottom of the page.

Summary

We discussed how we can extract the probability of an FOMC rate change using Fed fund futures. These futures reflect the market expectation of the FFE rate at the time of contract maturity.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Probability of an FOMC change spreadsheet