Long (short) risk reversal strategy

A long (short) risk reversal strategy combines long (short) calls and short (long) puts on the same underlying. These kinds of strategies exploit expected changes in the implied volatility of options, holding the expiration date constant.

On this page, we discuss the often-observed patterns in the relationship between implied volatility and the strike price. Next, we explain how traders can exploit deviations that are expected to correct using a risk reversal strategy.

Volatility smile and volatility skew

Holding expiration date constant, there are two often-observed patterns in the relationship between implied volatility and strike price:

- A volatility smile is where the further-from-ATM options have higher implied volatilities, so we would see a U-shaped (smiling) curve if implied volatility were plotted against strike. This shape is less common compared to the volatility skew, which we discuss next.

- A volatility skew is where implied volatility increases for more OTM puts, and decreases for more OTM calls. This is explained by OTM puts being desirable as insurance against market declines (so their values are bid up by higher demand, and higher values implied higher volatility), while the demand for OTM calls is low.

Deviations in the skew from historical levels can be used to draw conclusions about market sentiment:

- A sharp increase in the level of the skew, plus a surge in the absolute level of implied volatility, is an indicator that market sentiment is turning bearish.

- Higher implied volatilities (relative to historical levels) for OTM calls indicate that investors are bullish, so the demand for OTM calls to take on upside exposure is strong.

These are the kinds of temporary deviations that risk reversals strategies try to exploit.

Risk reversal strategy example

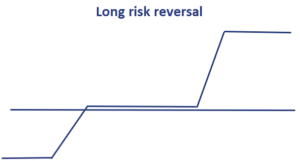

Let’s consider an example. Imagine a trader believes that put implied volatility is relatively too high, compared to that for calls. In that case, a long risk reversal could be created by:

- buying the OTM call (seen as relatively underpriced) and

- selling the OTM put (seen as relatively overpriced)

Both options would have the same expiration. This would create a broadly long exposure to the underlying, which would be problematic. The positive exposure comes from the positive delta from the long call and the short put.

The aim of the strategy is to make money if the anomalous relationship among the implied volatilities corrects. The strategy is not aiming to take a directional bet. Thus, we have to hedge the net long exposure we have. This can be done using a delta hedge. In this case, we would short the underlying stock.

Note that the delta of the risk reversal will change and the size of the hedge will have to be changed. Changing the hedge ratio over time is called dynamic hedging.

Summary

We discussed the basics of risk reversal strategies. These strategies try to exploit temporary deviations in the observed relationship between strike price and implied volatility.