Blended Taxation

Most portfolios are subject to multiple taxation methods and earn a portion (p) of the return from interest (i), dividends (d), and realized capital gains (rcg). In this case, blended taxation should be used to assess the impact of taxes on after-tax returns. The reason is that the different types of income are typically subject to different tax rates.

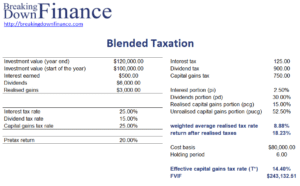

On this page, we provide all the necessary information to apply a blended taxation analysis. To this end, we need to calculate the weighted average realized tax rate (wartr), the return after realized taxes (r*), and the effective capital gains tax rate. An Excel spreadsheet that implements all the necessary formulas is available at the bottom of the page.

Blended taxation formulas

Before we continue, we should distinguish two cases.

- If all capital gains are realised and taxed each year, then the three portions of the return will sum to a 100% and the tax rate is simply a weighted average of the component tax rates

- If not all capital gains are realised, we have a portion of the return that is unrealized capital gains (or losses).

If there is a deferred tax portion, then the annual tax rate computation follows the following steps.

First, we calculate the weighted average realised tax rate (wartr):

where the p values refer to the portions and the t values refer to the tax rates.

Then the return after realized taxes is:

Next, we calculate the net effect of any deferred capital gains on ultimate after-tax return as follows. First we calculate the effective capital gains tax rate

or

Finally, we can calculate the after tax value as follows:

where B equals the ratio of the cost divided by the current value and n is the number of years.

Example effective capital gains tax rate

The following figure illustrates all the necessary steps using a numerical example. The Excel template used to create the example is available at the bottom of the page.

Summary

We discussed a simple method to assess the impact of taxes on after tax returns if different portions of the return are taxed at different tax rates. Our approach allows us to take into account potential future tax liabilities coming from unrealised capital gains.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Blended Taxation example