Modified Duration of the Equity Capital

The modified duration of the equity capital measures the sensitivity of the institution’s equity capital to a unit change in the reference yield, y, of the asset. This measure is used by banks and insurance companies to manage their balance sheet. On this page, we discuss how to derive the modified duration of the equity capital formula and discuss a numerical example.

Definition

First, we note that the primary objective of banks and insurance companies is to maximize the market value of the equity capital with a high level of confidence that the claims of the depositors, creditors, and policyholders can be met.

The impact of changes in market value on the market value can be analyzed using a formula. In particular, we can capture how changes in the market value of assets, liabilities, and leverage levels affect the change in the market value of the equity as follows:

where E is the value of the equity, A is the value of the assets, L is the value of the liabilities, and M is the leverage multiplier (A/E).

This equation can be modified to calculate the modified duration of equity

where DE is the modified duration of equity capital, DA is the modified duration of the assets, DL is the modified duration of the liabilities and the final term is the estimated change in the yield of the liabilities (i) relative to a unit change in the yield of the assets y.

Example

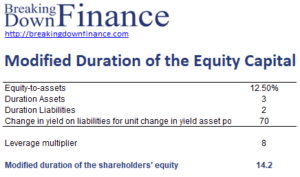

Next, let’s consider a simple numerical example to put the above formula into practice. The following table calculates the modified duration:

Summary

We discussed the modified duration of equity, a measure used by banks and insurers to manage their balance sheets.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Modified Duration of Equity example