Crisis alpha

Crisis alpha is a relatively recent concept that was introduced by Kathryn Kaminski. Crisis alpha refers to the fact that some strategies earn superior risk-adjusted returns during crises. One strategy in particular that is said to generate such alpha, is trend-following strategies. In this section, we illustrate the existence of crisis alpha and provide some potential explanations as to why it exists.

Crisis alpha definition

Crisis alpha means that the investment strategy generates positive returns in periods of high financial stress. One clear example of crisis alpha is when a manager is short the market when it crashes. In that case, the fund manager will generate large returns when other investors lose money. Of course, it is very hard to time the market. A more realistic case of a type of strategy that generates crisis alpha is trend-following strategies. Trend-following strategies employ technical analysis to enter and exit markets.

Trend-following strategies

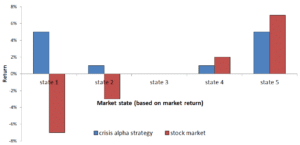

Trend-following strategies perform well when financial markets exhibit clear trends. When markets go up consistently over a certain period of time, a trend-following strategy will perform well. Similarly, when markets go down sharply in the matter of a couple of months, trend-following strategies will tend to perform well. This will give rise to the following distribution of the returns.

This illustrates the type of performance we expect from trend-following strategies. The good performance of the strategy during the bad market states (i.e. market state 1) is referred to as crisis alpha. The negative correlation of such alpha with market returns provides investors with diversification gains when their traditional securities (e.g. stocks and bonds) are performing badly.

Summary

On this page, we have discussed the concept of crisis alpha. It is a characteristic of divergent strategies that generate superior performance during equity market crises. Trend-following strategies, that generate this type of alpha, provide considerable diversification gains to investors during periods of financial stress.