Liquidity Planning Alternative Investments

Managing liquidity is a crucial aspect of an alternative investments program, especially one that includes private investments with near-term capital calldown periods and long investment horizons. A portfolio that includes these kinds of investments needs to be managed in a way that the portfolio meets its capital commitments while still providing required liquidity. On this page, we discuss the general principles used to perform liquidity planning for alternative investments. A liquidity planning spreadsheet can be downloaded at the bottom of the page.

Liquidity planning principles

The best way investors can manage liquidity is by developing forecasting models. Examples of liquidity modeling include projecting cash flows to and from a fund and forecasting the annual capital commitments needed to reach and maintain the targeted allocation to alternative investments. Let’s try to model both elements separately.

Capital contribution modeling

Cash flows for a typical private investment partnership are capital calls in the early years and distributions in the later years. An investor can make assumptions about how a fund will call its committed capital. A simple model for modeling contributions may look as follows:

Capital distribution modeling

The second step is modeling the distributions. Distributions can be modeled as a percentage of the fund’s net asset value. The NAV increases with capital calls and investment returns, and decreases with distributions. To estimate distributions, we use the IRR of the fund’s investments and a percentage of NAV to be distributed each period:

The NAV in period t will be equal to:

Example managing liquidity

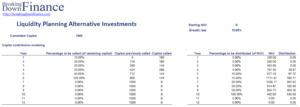

An example of the above methodology is illustrated in the following table:

The spreadsheet is available at the bottom of the page.

Discussion

Liquidity forecasting is important to manage how a portfolio reaches and maintains its target asset allocation. It will typically take a number of years to reach a certain target allocation. An investor will typically use the cash flow forecasting approach discussed earlier to project capital commitments.

But the work doesn’t stop there. The manager must also forecast the need to reinvest future distributions to maintain the target. Another important consideration is to stress-test the liquidity planning against unexpected events.

Summary

We discussed a simple method to perform liquidity planning when allocating to alternative investments.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Liquidity Planning Alternative Investments example