Bird-in-hand theory

The bird-in-hand theory for dividends or dividend preference theory argues that investors prefer stocks that pay high and stable dividends. The dividend preference theory was first proposed by Myron Gordon (1963) and John Lintner (1964). They proposed this theory in response to the dividend irrelevance theory of Modigliani and Miller (MM).

On this page, we discuss the bird-in-hand theory and contrast it with two other dividend theories, the dividend irrelevance theory and the dividend signaling theory.

Dividend relevance theory definition

It is important not to confuse the bird-in-hand theory with the dividend signalling theory. The dividend signalling theory argues that the dividend policy of companies conveys information about managers’ views on a company’s well-being, with dividend increases interpreted as a positive signal and dividend decreases interpreted to indicate lower profitability going forward. A popular theory on dividend signaling is the pecking order theory.

The bird-in-hand theory argues that investors prefer dividends over capital gains (that are a result of the firm retaining and reinvesting the earnings) because it is more certain. As a consequence, investors require a higher return when companies retain a large fraction of the earnings. That’s because investors are risk averse and future capital gains are uncertain.

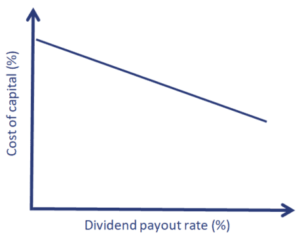

The following figure illustrates the relationship between the cost of capital and the dividend payout rate under the bird-in-hand theory. Higher dividends are expected to drive down the cost of capital because investors prefer such companies.

Dividend preference theory versus dividend irrelevance

The implications of the bird in the hand theory for dividend policy is evident. Investors will prefer companies that distribute dividends, which will drive up the companies’ share prices. The dividend preference theory contrasts strongly with the dividend irrelevance theory of Miller and Modigliani.

Modigliani and Miller argue that the dividend policy of a company does not matter for investors in a frictionless market. The authors responded to the Modigliani the bird-in-hand theory calling it the bird-in-hand fallacy. They argue that investors will reinvest the dividends in similar companies or even the same company. Thus, the money is reinvested and thus equally risky. In that case, investors should again be indifferent between dividends and future capital gains.