Greater fool theory

The greater fool theory is a theory some investors might implicitly or explicitly be relying on when investing in financial markets. The greater fool theory states that,

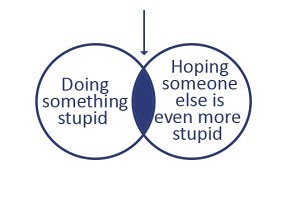

as long as you can find a greater fool to sell the security to, the current price of a security can still be rationalised.

In other words, as long as you think other people will be willing to pay an even higher price for the security, it makes sense to purchase the security at the current price. No matter how high the price, you can make a profit if you can find a ‘greater fool’.

Greater fool theory in practice

Most of the time, when investors are relying on the greater fool theory, they do not realise it it. In particular, when investors buy a security because they think it will go up further, without much regard for the security’s fundamentals, then they are probably relying on the greater fool theory. This is a very risky strategy. There is a distinct risk that these investors are the ‘greater fool’. In addition, they run the risk that if sentiment turns, they will not be able to find someone to sell the security to. Especially during bubbles, this effect might be at play.

Summary

Even though prices cannot be justified based on fundamentals, the above greater fool theory might give investors a justification for buying a security. However, as this strategy is very risky, it’s best not to rely on it.