Loss aversion

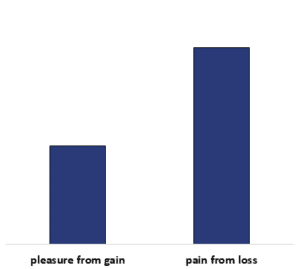

An important element in prospect theory is the finding that people experience gains and losses differently. In particular, research by Kahneman and Tversky suggests that people prefer avoiding losses twice as much as acquiring gains. This kind of behavior is called loss aversion. On this page, we provide a simple example that explains the concept of loss aversion.

Example of loss aversion

A simple way of illustrating the importance and magnitude of loss aversion can be done using a fair coin. Suppose we can opt to take part in a bet that involves flipping a fair coin. If it’s tails, we lose $10. How much would we have to win in order for this gamble to be acceptable for us? If we want to behave ‘rationally’, a payoff of $10 in the case of heads is enough, as the expected value is then zero

where the likelihood of heads or tails is 50% in both cases. Hence, one average we will be equally well-off taking or not taking the gamble. Any gamble where we earn more than $10 should be worth engaging in. In practice however, people answer that they want to receive more than $20 before they’ll accept the gamble. In that case, the expected payoff is $15

By not taking the gamble for gains between $10 and over $20, people are leaving a lot of money on the table.

Loss aversion also plays an important role in explaining sunk cost effects. In particular, when people have spent money on something, they feel obliged to commit to it. For example, people tend to feel obliged to go to an event for which they have bought a ticket, even if they no longer really want to attend the event. They feel that they would be wasting the ticket price. While such behavior is ineffcient because it misallocates resources, people don’t want to waste resources (loss aversion).

Summary

Loss aversion is the empirical observation that people tend to avoid losses, even in case where they should be indifferent to different outcomes.