Pompian Behavioral Model

The Pompian behavioral model is a behavioral model used to classify investors in four different behavioral investor types (BITs). The model was proposed by Michael Pompian in 2008 in an article titled “Using Behavioral Investor Types to Build Better Relationships with Your Clients”.

On this page, we discuss how the Pompian behavioral model can be used to classify investors. We should note that there is one other behavioral model that can be used to classify investors. These are the Barnewall two way model and the Baillard, Biehl, and Kaiser (BB&K) five way model.

Pompian behavioral model definition

The Pompian behavioral model argues that an adviser can go through a 4-step process to determine an investor’s Behavioral Investor Type (BIT). The four steps are:

- Interview the client to determine if he or she is active or passive as an indication of her risk tolerance

- plot the investor on a risk tolerance scale

- test for behavioral biases

- classify the investor into one of the BITs

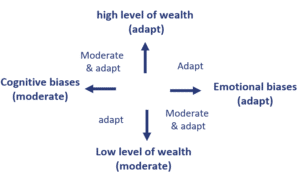

The following figure shows the four investor types and reports the most important cognitive and emotional biases associated with each investor type. The four investor types are the passive preserver, the active accumulator, the friendly follower and the independent individualist. The former two tend to make emotional decisions whereas the latter two use a more thoughtful approach to decision-making.

The most common cognitive biases per investor type:

- Passive preserver: mental accounting

- Friendly follower: availability bias

- independent individualist: conservatism

- active accumulator: illusion of control

The most common emotional biases for each investor type are:

- Passive preserver: endowment, loss aversion

- Friendly follower: regret aversion

- independent individualist: overconfidence

- active accumulator: self-control

Behavioral investor types (BITs)

The final step of the Pompian behavioral model is to determine which behavioral bias the investor is exhibiting and using that information to determine the investor type. The 4 investor types are defined as follows:

- The passive preserver: has a low risk tolerance, emotional bias, not willing to risk his own capital, not financially sophisticated, and difficult to advise because he is driven by emotion. They respond to high-level overviews but don’t respond to quantitative details.

- The friendly follower: a passive investor who has low to moderate risk tolerance and suffers mainly from cognitive biases. These are errors that result from cognitive biases and are thus easier to remedy. They follow the tips of friends and colleagues. He or she tends to overestimate risk tolerance and wants to be in the most popular investments.

- The independent individualist: is an active investor who is willing to risk his own capital and give up security to gain wealth. He or she has moderate to high risk tolerance and suffers from cognitive biases. Difficult to advise but will listen to sound advice.

- The active accumulator: has a high risk tolerance and invests emotionally. He or she is usually an aggressive investor. Strong-willed, confident and thus most difficult to advise.

Summary

We discussed the Pompian behavioral model, which is used to classify investors in behavioral investor types (BITs).