Baillard, Biehl, and Kaiser model (BB&K) five way model

The Bailard, Biehl and Kaiser five-way model (BB&K) is a behavioral finance model that can be used to classify investors into behavioral types. The model was proposed in 1986 in a book titled “Personal Money Management. The model classifies investors along two dimensions according to how they approach life in general.

On this page, we discuss how the BB&K model works. We also graphically present the two dimensions needed to classify investors. We also note that there are two other behavioral models that can be used to classify investors. These are the Barnewall two way model and the Pompian behavioral model.

BB&K model definition

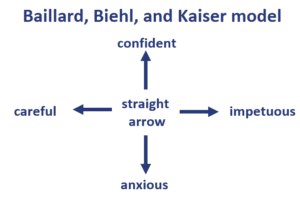

Baillard, Biehl, and Kaiser model (BB&K) five way model classifies investors along the following two dimensions:

- The first dimension is confidence. In particular, the model identifies the level of confidence displayed when the individual makes decisions. This can very from confident to anxious.

- The second dimension is the method of action. The model measures an individual’s approach to decision making. Some people are very methodical in making decisions whereas others tend to be more spontaneous. The method of action varies from careful to impetuous.

Based on these two dimensions, BB&K identify five behavioral types, which lie a different points in a grid formed by confidence/method of action. Using the two dimension just outlined, we identify the following set of behavioral types:

- The adventurer

- Confident and impetuous (northeast quadrant)

- concentrated portfolios

- willing to take risk

- likes to make own decisions

- The celebrity

- Anxious and impetuous (southeast quadrant)

- recognizes limitations

- seeks and takes advice

- The individualist

- Confident and careful (northeast quadrant)

- likes to make own decisions after analysis

- good to work with because they listen and process information rationally

- The guardian

- Anxious and careful (southwest quadrant)

- concerned with the future and protecting assets

- may seek advice of people they perceive as more knowledgeable

- the straight arrow

- average investors (intersection)

- neither confident nor anxious

- neither overly careful nor impetuous

- willing to take increased risk for increased expected return.

The following figure illustrates the two dimensions

Summary Bailard, Biehl and Kaiser five-way model

We discussed the Baillard, Biehl, and Kaiser (BB&K) five way model. Other popular models that can be used to classify investors are the Barnewall two way model and the Pompian behavioral model.