Riding the Yield Curve

Riding the yield curve is probably the most straightforward active strategy a bond investor can consider. Rather than maturity matching, that is making sure that the bonds’ maturity equals the investor’s investment horizon, a rolling down the yield curve strategy buys longer-term bonds.

On this page, we discuss the riding the yield curve strategy and discuss a riding the yield curve example.

Rolling down the yield curve strategy

The rolling down the yield curve strategy is performed as follows. An investor purchases bonds with a maturity that is longer than his or her investment horizon. In an upward-sloping yield curve environment, longer maturity bonds have higher yields and shorter maturities have lower interest rates. Thus, as the bond approaches expiration, it is valued at successively lower interest rates and thus at successively higher prices.

If, and this is a very important assumption, the yield curve stays unchanged, then the rolling down the yield curve strategy will produce higher returns than the maturity-matching strategy. The greater the difference between the forward rate and the spot rate, the higher the total return.

Riding the yield curve example

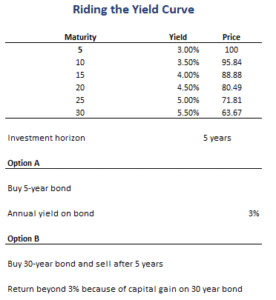

Finally, let’s have a look at the riding the yield curve calculation. In particular, let’s look at an investor who pursues such a strategy. The following table provides a hypothetical situation in which an investor buys longer-dated bonds. We used a simple rolling down the yield curve Excel spreadsheet to create this example.

If there is no change in the yield curve over the investment horizon, the investor will earn both a coupon and experience a capital gain. Clearly, such a strategy is not without risk. There is no guarantee that the yield curve will remain unchanged.

Summary

We provided a rolling down the yield curve explanation. Also known as a riding the curve strategy, it is very easy to apply but will only work if the yield curve remains unchanged.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file:Rolling down the Yield Curve template