EPS bootstrapping

EPS bootstrapping or the bootstrap earnings effect is a practice in corporate finance used to boost the earnings per share (EPS) and to increase the stock price. Bootstrapping in mergers and acquisitions is a common practice that investors should be aware of. That’s because the bootstrap effect has no economic benefits to a company. The merger produces increased earnings per share but the combined value of the firms is still equal to the sum of the separate parts.

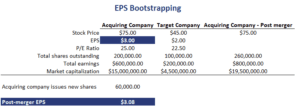

On this page, we explain how EPS bootstrapping works, and provide a numerical example that illustrates the effect. We implement the example using an Excel spreadsheet.

EPS bootstrapping

Bootstrapping occurs in the context of M&As. In this case, the acquirer buys a company with a low Price-Earnings (P/E) through a stock swap. The goal is to boost the post-acquisition EPS of the newly created company and to increase the stock price.

Thus bootstrapping automatically occurs when acquirer’s Price-Earnings is higher than the Price-Earnings of the target company and a stock transaction is executed to perform the merger or acquisition. Of course, the whole approach is just accounting trickery. In principle, the market will recognize what is happening and the acquirer’s price will adjust to account for the effect. In that case, the P/E of the company will be unchanged.

If, however, investors are not careful in reviewing the actions of the acquiring company, they may be tricked. In that case, the stock price does not fully adjust and the stock price may be boosted.

Bootstrapping EPS example

Let’s have a look at a bootstrapping EPS example. Suppose we have two companies, where one company is acquired by the other company.

Bootstrapping EPS long term effects

While bootstrapping may provide a temporary increase in the stock price if investors don’t realize the trickery, the effect will disappear over time. The only way to keep the Price-Earnings artificially high is to continuously buy other companies. This is not possible, so eventually the P/E will adjust and the stock price will go down.

Summary

We discussed bootstrapping. The bootstrap effect occurs when a high P/E firm acquires a low P/E firm in a stock transaction. In the process, the acquirer exchanges higher priced shares for lower priced shares.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: EPS Bootstrapping template