Reclassification of Financial Assets

Reclassification of investments in financial assets is treated differently under the main international account standards (IFRS and US GAAP).

On this page, we discuss how different types of financial assets can be reclassified by companies.

IFRS

IFRS typically does not allow a reclassification of investments into or out of the designated at fair value category. For example, the reclassification of investments out of the held-for-trading category is severely restricted under IFRS:

- Debt securities classified as available-for-sale can be reclassified as held-to-maturity if the holder of the debt intends to (and is able to) hold the debt to its maturity date. The security’s balance sheet value is remeasured to reflect its fair value at the time it is reclassified. Any difference between this amount and the maturity value, and any gain or loss that has been recorded in other comprehensive income, should be amortized over the security’s remaining life.

- Held-to-maturity securities can be reclassified as available-for-sale if the holder no longer intends or is no longer able to hold the debt to maturity. The carrying value is remeasured to the security’s fair value, with any difference recognised in other comprehensive income. Note that reclassifying a held-to-maturity security may prevent the holder from classifying other debt securities as held-to-maturity, or even require other held-to-maturity debt to be reclassified as available-for-sale.

U.S. GAAP

U.S. GAAP is more flexible and does permit securities to be reclassified into or out of held-for-trading or designated at fair value. Unrealized gains are recognised on the income statement at the time the security is reclassified.

- For investments transferring out of available-for-sale category into held-for-trading category, the cumulative amount of gains and losses previously recorded under other comprehensive income is recognised in income.

- For a debt security transferring out of available-for-sale category into the held-to-maturity category, the cumulative amount of gains and losses previously recorded under other comprehensive income is amortized over the remaining life of the security.

- For transferring investments into the available-for-sale category from the held-to-maturity category, the unrealised gain/loss is transferred to comprehensive income.

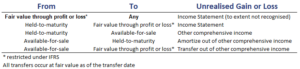

The following figure summarizes the rules for reclassification:

Summary

We discussed the reclassification of investments in financial assets under IFRS and U.S. GAAP.