Baker and Wurgler Sentiment Index

The Baker and Wurgler Sentiment Index (BWSI) is a measure of investor sentiment that was developed by Malcolm Baker and Jeffrey Wurgler in 2006. The BWSI was proposed in a paper called ‘Investor Sentiment and the Cross-Section of Stock Returns’ in 2006.

The index attempts to quantify the degree of bullish or bearish sentiment in the stock market by analyzing the behavior of individual investors.

Baker and Wurgler Sentiment Index Definition

The BWSI is calculated by analyzing the following 5 proxies for investor sentiment:

- Closed-end fund discount (CEFD)

- The first-day returns of initial public offerings (IPOs)

- IPO volume

- The value-weighted dividend premium (difference between book-to-market of dividend paying and non-dividend paying stocks)

- The equity share in new issues

Initially, the BW index included the NYSE turnover ratio as a sixth metric, but Baker and Wurgler decided to drop the variable in the latest update of their sentiment index update.

The above proxies are based on the idea that when investors are bullish, they tend to invest more in stocks and buy more IPOs, while when they are bearish, they tend to invest more in bonds and closed-end funds. The BWSI is calculated as the average z-score across these proxies.

Baker and Wurgler Sentiment Index Interpretation

A z-score is a statistical measure that represents the number of standard deviations a data point is from the historical mean of the dataset. Thus:

- a positive z-score indicates that the proxy is above its historical average and suggests that investors are bullish,

- a negative z-score indicates that the proxy is below its historical average and suggests that investors are bearish.

There are several advantages to using the BWSI:

- Unlike subjective surveys or opinions, BWSI provides a quantitative measure of investor sentiment based on the behavior of individual investors. As such, it is a more objective and reliable indicator of market sentiment.

- BWSI has been shown to be a useful predictor of market trends: Studies have shown that the BWSI is a useful predictor of future stock market returns. A high BWSI is associated with lower future stock market returns, while a low BWSI is associated with higher future stock market returns.

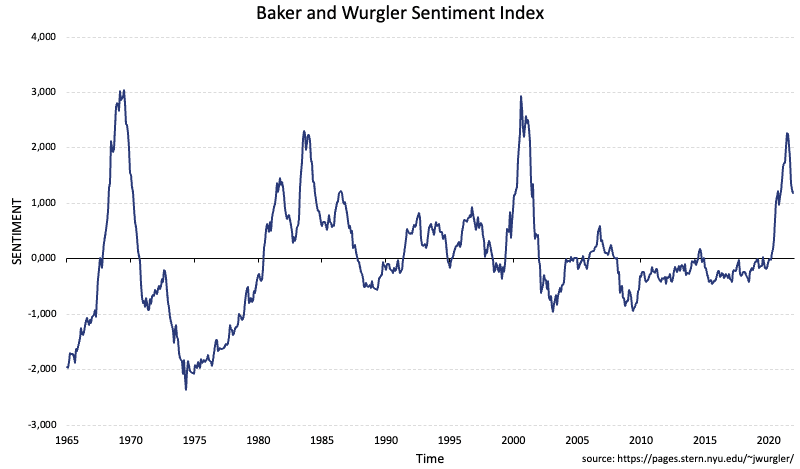

The following figure plots the evolution of stock investors’ sentiment over time:

Summary

We discussed the Baker and Wurgler Sentiment measure, a sentiment indicator that is found to successfully predict whether future returns will be higher or lower than average. BWSI captures overoptimism much in the same way as the CAPE ratio.