Converting Return in Foreign Currency

Converting a return in foreign currency is needed when the investment in assets is priced in a currency other than the investor’s domestic currency. A foreign asset priced in a foreign currency has two sources of risk.

On this page, we discuss both sources of risk and then discuss the formula as well as an approximation to convert the returns to domestic currency returns. At the bottom of the page, an Excel spreadsheet is available for download.

Foreign currency return risks

First, let’s discuss the two sources of risk that follow from investing in a foreign asset priced in a foreign currency:

- The first source of risk is the return on the assets in the foreign currency

- The second source of risk is the return on the foreign currency from any change in its exchange rate with the investor’s domestic currency

These two kinds of return are multiplicative.

Foreign return currency conversion formula

An investor’s returns in domestic currency can be calculated using the following formula

![]()

where DC is the return in domestic currency, FC is the return in foreign currency, and FX is the currency return. This approach is precise if the precise FX return is known. Alternatively, we can also approximate the return

![]()

This approach is acceptable when precision is not needed. In both cases, it is important to use the foreign currency expressed in the base currency (the denominator) to calculate the change in the value of the currency.

Example

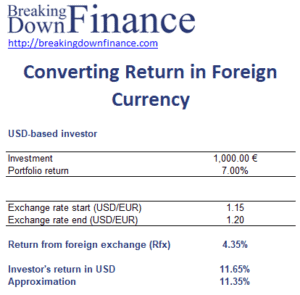

Let’s conclude with a numerical example of how to convert the return in foreign currency in domestic currency. The following table implements the necessary steps.

The spreadsheet is available for download at the bottom of the page.

Summary

We discussed how to convert a return in a foreign currency to a return in domestic currency. There are two approaches that an investor can use, depending on the level of precision required.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Converting Return in Foreign Currency Example