Deferred Capital Gains Taxation

Deferred capital gains taxation refers to taxes that are only applied to the gain in value on an investment. Generally, the timing of the tax is controlled by the individual. This is because a capital gains tax is only imposed when the asset is sold by the investor. Deferring the tax has the advantage that the benefits of pretax compounding can be realised. This will always lower the tax drag.

On this page, we discuss how to calculate the after tax value under capital gains taxation. We also discuss a number of generalizations that relate to capital gains taxes. A spreadsheet that implements the formulas is available at the bottom of the page.

Capital gains taxation formula

We can calculate the future value of an investment after tax under capital gains taxation as:

where r is the pretax return, n is the number of years, tcg is the capital gains tax, and B is the cost basis which is defined as the cost divided by the asset’s current value. The advantage of this formula is that we can easily consider the tax implications of a basis other than 1.

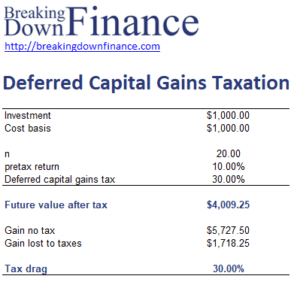

Deferred capital gains example

Let’s implement a simple example, in which we also calculate the tax drag. The spreadsheet used can be downloaded at the bottom of the page

Deferred capital gains taxation properties

Let’s finally discuss a few characteristics that hold generally:

- there is no lost compounding of return since the tax are only paid at the end of the time horizon

- the tax drag amount will increase as the time horizon and/or rate of return increase

- the tax drag percentage will

- equal the capital gains tax if B is 1

- will be higher than the capital gains tax if B is less than 1

- will be lower than the capital gains tax if B is more than 1

Summary

We discussed the effects of capital gains taxation on the ending value of an investment. The formula we presented has the advantage that it can easily be used for assets that have a cost basis different from 1.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Deferred Capital Gains Taxation example