Generation skipping

Generation skipping refers to gifting assets directly to a third generation. This is typically done to avoid possible double taxation. Skipping generations is a useful tactic particularly in countries that don’t have generation-skipping transfer taxes, such as the United States.

On this page, we discuss the issue of double taxation in more detail and provide a formula that allows us to quantify the benefit of using skipping generations to avoid double taxation.

Generation skipping explained

Imagine we don’t skip generations. In that case, the first (i.e. oldest) generation transfers assets to the second generation and this transfer is typically subject to gift taxes. Then when the second generation transfers the assets to the third generation, the assets are taxed again. Clearly, gifting the taxes directly to the third generation will lead to lower taxes. We can easily calculate the advantage of skipping generations.

Generation skipping formula

First, let’s compare the future value of no skipping:

where r is the rate of return, tg is the tax rate on gifting and n1 and n2 are the periods for which each generation holds the assets.

Next, the value under skipping is:

where N = n1 + n2.

Now, it can be shown that the ability to skip generations will increase the value to the third generation by a factor of

This is the relative value of skipping.

Numerical example

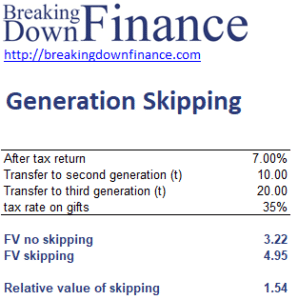

Let’s consider a numerical example. The following table implements the above formula. The spreadsheet used to create the example can be downloaded at the bottom of the page.

Summary

We discussed skipping generations to increase the value to the third generation from gifting assets. It is important to keep in mind that the first generation should gift only the excess above the core capital requirements for both the first and the second generations.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Generation Skipping Example