Net Surrender Cost Index

The net surrender cost index method is a common approach used to compare the cost of different life insurance contracts. Because different life insurance policies can vary widely (e.g. they may have different riders), this approach is a simple way to try and express the cost in a single figure. Often, regulation requires insurers to report the net surrender cost.

This net surrender cost approach is strongly related to the net payment cost index. That approach is similar, but does not assume the individual terminates the policy at the end of the horizon.

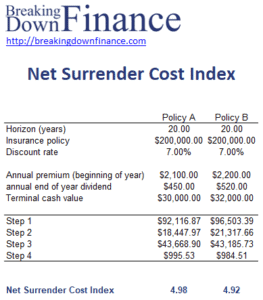

On this page, we discuss the net surrender cost index steps. We also include a spreadsheet at the bottom of the page that implements a numerical example of the approach.

Net surrender cost index definition

The net surrender cost approach assumes the individual terminates the policy at the end of the horizon and the cash value is received.

The necessary steps in this case are:

- compute the future value of the premiums paid, an annuity due (dividends at the start of the year)

- compute the future value of the dividends, an ordinary annuity (dividends at the end of the year)

- compute the future value, i.e. step 1- step 2 less the projected cash value

- annuitize this future value difference for the annual cost (annuity due because premiums are paid at the start of the year)

- Divide the results by $1000 of insurance policy amount to index the annual cost

The annuity due and ordinary annuity can be done using a spreadsheet or a financial calculator.

Example

Let’s turn to a numerical example to clarify the above steps. The following table implements a numerical example. The calculator, implemented using Excel, can be downloaded at the bottom of this page.

Summary

We discussed the net surrender cost approach. This approach is strongly related to another approach used to compare the cost of different life insurance policies called the net payment cost index approach.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Net Surrender Cost Example