Retained Earnings Breakpoint

The Retained Earnings Breakpoint determines the amount of new capital that can be raised before the target capital structure changes. If the company exceeds the breakpoint, it will have to raise additional equity. Raising additional equity is costly and may increase the weighted average cost of capital (WACC). Thus, financial managers will try to stay below the breakpoint if possible.

On this page, we discuss the formula and present an example in Excel. The retained earnings breakpoint calculator is available at the bottom of the page.

The retained earnings breakpoint definition

Companies can finance new projects in at least two ways. First, they can use equity to finance a project. Alternatively, they can borrow money. Borrowing money will change the capital structure of the company and may cause it to deviate from the optimal capital structure. Unless the company is able to increase equity as well. The easiest way to increase equity is by retaining earnings.

Thus, the amount of earnings the company can retain determines the amount of debt the company can take on without changing the capital structure. The breakpoint simply measures the amount of new capital that can be raised before the capital structure changes. This is important because deviating from the optimal capital structure generally causes the WACC to go up. Thus, companies will try to stay close to the optimal capital structure.

Retained Earnings breakpoint formula

Let’s have a look at the retained earnings breakpoint formula

where We is the percentage weight of equity in the optimal capital structure.

Earnings breakpoint example

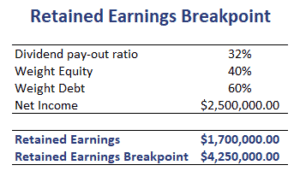

Let’s consider an example. The following table calculate the earnings breakpoint for a company.

The Excel file used to create the example is available for download at the bottom of the page.

Summary

We illustrated how a company can determine the amount of earnings it should retain to maintain the target capital structure when it want to invest in new projects.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Earnings Breakpoint template