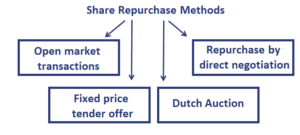

Share Repurchase Methods

How does a share buyback work? There are four common methods that companies use to buyback shares. Not all of these methods are allowed in all countries. The cost, to the company, of buying back shares will also depend on the method chosen, as some methods lead to higher prices paid by the company than others.

On this page, we discuss the four most common types of share repurchase methods. We discuss each methods as well as the advantages and disadvantages, if applicable. Let’s start by discussing the share buyback process under each of the methods.

Open market transactions

The most straightforward and flexible way to buy shares is simply buying them in the market at the best possible price. This approach is the most flexible approach because the company is under no obligation to complete the announced buyback program in full.

Another advantage is that US companies do not require shareholder approval to perform open market transactions.

Fixed price tender offer

A fixed price tender offer share buckback is an approach where the firm buys a predetermined number of shares at a fixed price. To convince shareholders to sell the shares to the company, the fixed price will typically be higher than the current market price (i.e. at a premium). The advantage of this approach is that the company can buy back the shares quickly.

The disadvantage is that only the shareholders that are able to sell at the fixed price will earn a premium.

Dutch auction share buyback approach

This is similar to a tender offer except that the company does not specify a fixed price. Instead, shareholders are provided with a range. The shareholders can then offer their shares and have to specify the price at which they are willing to share. A Dutch auction means that the minimum price will then be determined as the price that ensures that the full amount of shares that need to be repurchased are in fact repurchased.

Under this method, bids are accepted based on the lowest price first until the desired amount of shares is filled. The price of the last offer is used as the price that is paid for all shares tendered.

Repurchase by direct negotiation

The final method is repurchase by direct negotiation. Under this method, shares are purchased from a major shareholder. This often occurs at a premium over the market price. The reason for this is the fact that this method is often used in the case of a greenmail scenario.

Summary

We discussed the buyback of shares procedures that are commonly used in the US, Canada, and Europe.