Suspicious trading examples

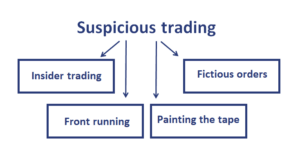

Suspicious trading is trading that regulators will investigate if it occurs because it is illegal. Regulators will continuously monitor financial markets in order to identify abnormal movements. there are a number of types of suspicious trading that are considered illegal. On this page, we discuss a number of suspicious trading examples; insider trading, front running, painting the tape, fictitious orders (quote stuffing, layering, spoofing), wash trading, and trader collusion.

Insider trading

Insider trading is when a trader makes transactions based on information that is not publicly available and material. It can typically be spotted when a trader engages in large transactions in securities that he or she does not typically trade and these trades are highly positive. Especially when this pattern repeats frequently, insider trading may be taking place.

Front running

Front running is when a trader has knowledge of a large buy order and trades slightly earlier than the large trade to profit from the price movement that the large trade will cause.

Painting the tape

Painting the tape occurs when a trader executes a large set of small buy orders to drive up the market price. He or she will then sell a large position he or she wants to get rid of.

Fictitious orders

Trader may submit fictitious orders to move the market price. There are several ways in which fictitious orders can be used to manipulate the market.

In the case of quote stuffing, the trader submits a lot of orders into the market. He or she then almost immediately cancels them again. The objective is to distract other market participants and to benefit from any mispricings that may take place because of the confusion

Layering consists of placing actual orders on one side and placing layers of fake orders on the other side of the market. The objective of the false orders is to motivate other market participants to transact with the genuine orders.

spoofing occurs when an algorithm places orders between the bid and the ask price. The aim is to cancel these trades before they execute. These fake orders are intended to create false pessimism or optimism among other market participants.

Wash trading

Wash trading is when an algorithm buys and sells the same securities repeatedly to generate false trading volume. This trading volume may attract other market participants. This increases the demand for a security that the algorithm wants to sell.

Trader collusion

Finally, trader collusion is when multiple traders collaborate to push markets into a certain direction that is favourable to them.

Summary

We discussed different ways in which traders and algorithm may manipulate the market. Regulators are constantly screening the market for this kind of illegal behaviour.