Target payout adjustment model

The target payout adjustment model is a method companies can use to change their dividend payout ratio to a target level. The target payout adjustment method is a kind of stable dividend policy that companies use to ensure that their dividend policy is stable. The objective of a stable dividend policy approach is to align the company’s dividend growth rate with the company’s long-term earnings growth rate.

The main reason that many company try to have a stable dividend policy is because there are advantages to having a stable dividend policy. In particular, many investors prefer companies that have stable dividends. Thus, a stable dividend will increase demand for the stock, leading to a higher stock price.

On this page, we discuss how a company can move to a target payout ratio or target dividend. In particular, we discuss the target payout adjustment model formula as well as an example. The example is implemented using Excel and is available for download at the bottom of the page.

Target payout adjustment formula

Let’s start by discussing the formula that can be used to forecast the expected increase in the dividends if the company follows a target payout adjustment method. The formula looks as follows

where the adjustment factor is equal to 1/number of years over which the adjustment will take place.

Target payout adjustment example

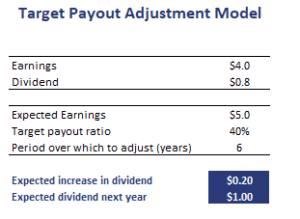

Let’s have a look at and example, so we can illustrate the dividend payout ratio calculator for a company that aims to pay a stable dividend. The following table illustrates the necessary calculations.

The spreadsheet can be downloaded at the bottom of the page.

Summary

We discussed the stable dividend payout adjustment method. The method is very useful to anticipate a company’s dividend if we know that company follows a stable dividend policy approach.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Target Payout Adjustment Model template