Volume-weighted Average Price (VWAP)

Volume-weighted average price (VWAP) is a trading benchmark used by traders that represents the average price at which a security has traded over a specific period, taking into account the volume of shares traded at each price level. It is calculated by adding up the dollars traded for every transaction (price multiplied by number of shares traded) and then dividing by the total shares traded.

VWAP is mainly used as a benchmark for the pricing of a large order, as it helps traders determine the average price at which the order can be filled. It can also be used by individual investors as a reference point to determine if they are getting a good price for a security.

VWAP can also be used for technical trading, in which case it should be used in conjunction with other technical indicators to make trading decisions. For example, if the current price is above the VWAP, it may be considered overvalued, while if it is below the VWAP, it may be considered undervalued. This is an example of a mean-reversion strategy.

On this page we discuss the advantages and disadvantages of the volume-weighted average price and illustrate the approach with an example in Excel. The spreadsheet is available for download at the bottom of the page.

Advantages VWAP

There are several advantages to using VWAP as a trading benchmark:

- VWAP is easy to calculate

- VWAP is widely used and recognized by traders, making it a useful benchmark for comparison with other trading strategies.

- VWAP reflects the average price at which a security has traded over a specific period, taking into account the volume of shares traded at each price level. This can be useful for traders looking to fill a large order, as VWAP helps them determine the average price at which the order can be filled.

- VWAP can help traders identify trends in the market. For example, if the VWAP is trending upwards, it may indicate that the security is gaining momentum and trend-following traders will buy. Conversely, if the VWAP is trending downwards, it may indicate that the security is losing momentum and trend-following traders will sell.

Disadvantages VWAP

The disadvantages of VWAP include:

- VWAP is based on historical data so it does not take into account expected future events that may affect the price of a security

- VWAP is not always applicable to all types of securities. It may not be as useful for thinly traded securities as the volume of trades may be too low to provide a meaningful average price

- VWAP can be affected by manipulation, such as traders intentionally trading large volumes of a security at specific price levels to influence the VWAP. This can make it difficult to rely on VWAP as a reliable benchmark

VWAP Example

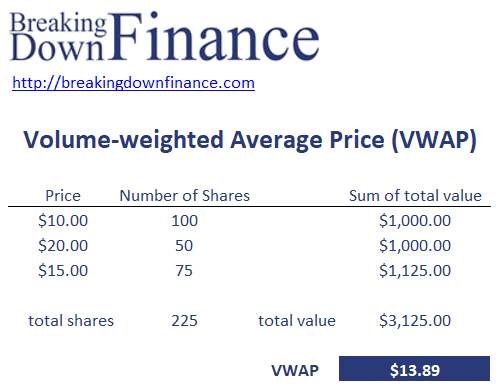

The formula for calculating the Volume Weighted Average Price (VWAP) is:

VWAP = (Sum of the total value of all trades / Sum of the number of shares)

Let’s apply the above formula. Imagine that over a period of 5 minutes a stock has traded 100 shares at a price of $10, 50 shares at a price of $20, and 75 shares at a price of $15.

The value traded at the $10 price level is 100 * $10 = $1000.

The value traded at the $20 price level is 50 * $20 = $1000.

The value traded at the $15 price level is 75 * $15 = $1125.

The total dollar value traded for the period is $1000 + $1000 + $1125 = $3125. The total shares traded for the period is 100 + 50 + 75 = 225. Therefore, the VWAP for the period is $3125 / 225 = $13.89.

This means that over this particular 5 minute period, the average price at which the stock traded was $13.89, taking into account the volume of shares traded at each price level. An Excel implementation of the example is available for download at the bottom of the page.

Summary

Volume-weighted average price (VWAP) is a commonly used trading benchmark that represents the average price at which a security has traded over a specific period. VWAP is mainly used as a benchmark for benchmarking the execution of large orders.

VWAP Excel Implementation

The Excel document implements the approach in Excel: VWAP calculator