Private Company Valuation Approaches

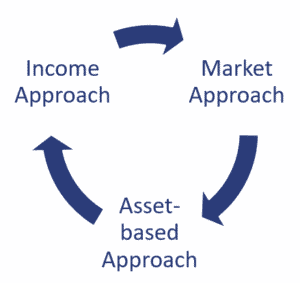

The three major approaches to private company valuation are the income approach, the market approach, and the asset-based approach:

- Income approach: Values a firm as the present value of its expected future income. Such valuation may be based on a variety of different assumptions and variations.

- Market approach: Values a firm using the price multiples based on recent sales of comparable assets.

- Asset-based approach: Values a firm’s assets minus its liabilities.

On this page, we provide a brief overview of the different methods and discuss when to use which method. In particular, depending on the lifecycle stage of the company or the type of operations, a different approach may be more appropriate.

Choosing the private company valuation approach

The three different models are similar to approaches used to value public companies, but they have different names. In the public equity world, the income approach is known as the discounted cash flow or present value analysis. The income approach and the asset-based approach are termed absolute valuation models. That is, the value generated is not relative to recent valuations of other assets, as they are with the market approach.

The selection of the appropriate valuation approach depends on the firm’s operations and its lifecycle stage:

- Early in its life, a firm’s future cash flows may be subject to so much uncertainty that an asset-based approach would be most appropriate

- As the firm moves to a high growth phase it might be appropriately valued using an income approach, including a particular form of the income approach known as the free cash flow valuation model

- A mature firm might be more appropriately valued using the market approach.

Firm size is also a consideration in choosing a valuation methodology. Price multiples from large public firms should not be used to value a small private firm without some assurance that the risk and growth prospects of the firms are similar.

A firm’s assets typically consist of both operating and nonoperating assets. Non Operating assets, those not crucial to the firm’s primary operations and focus, are typified by excess cash and investment accounts. However, non operating assets constitute a portion of firm value and must be included when valuing a firm.

Summary

We briefly discussed private company valuation approaches and how to choose the appropriate approach based on the company’s operations and lifecycle stage.