Intraday momentum

Intraday momentum is a trading strategy recently identified by academia. The strategy is executed intraday and is said to be profitable, especially during periods of financial stress. On this page, we explain the concept of intraday momentum, and discuss two potential explanations that might drive the observed effect.

What is intraday momentum?

Intraday momentum is the empirical finding that het first-half hour return of the trading day appears to positively predict the last half-hour return of the trading day. Econometrically

where is the first half-hour return (based on the closing price at day

,

is the last half-hour return),

is the constant, and

is the error term. In a recent paper, Gao, Han, Li, and Zhou (2015) were the first to point out the existence of intraday momentum.

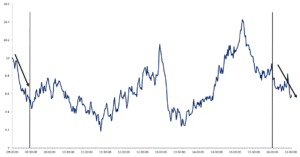

The following figure provides a simple example of what intraday momentum implies. In particular, intraday momentum argues that there is a positive relationship between the first-half hour return and the last half-hour return. This means that, when the price drops (increases) during the first half-hour (compared to the closing price the previous day), then the return during the last half hour is, on average, negative (positive).

Potential drivers of intraday momentum

Gao, Han, Li, and Zhou (2015) suggest two potential explanations for the observed effect.

- First, the authors suggest that intraday momentum could be caused by informed traders. Informed traders prefer to trade when there is enough liquidity, such that they can hide their trades from other investors and minimize market impact. At the same time, it is true that over the trading day liquidity (volume) tends to exhibit a U-shape. If informed traders are pushing prices, and they tend to trade in the morning and in the evening when the liquidity is high, then this might create the intraday momentum.

- The second potential explanation is related to liquidity provision. When market participants want to trade in reaction to news that was realised overnight, then they will do that when the market opens. Other traders will sell their positions to provide liquidity in the process. However, while the daytraders may close out their positions quickly, they might be tempted to hold on to their losing positions (due to a disposition effect). At the same time, as the trading day comes to an end, en the daytraders don’t want to hold positions overnight, they are forced to liquidate towards the end of the day. This too, might generate the intraday momentum.

Summary

We have discussed intraday momentum, which is a positive relationship between the first half-hour return and the last half-hour return. It is a relatively recent phenomenon that has received considerable attention.