Leveraged portfolio return

Leverage is a way to increase portfolio return. Especially in periods of low interest rates the use of leverage can be attractive. The leveraged portfolio return is the return that the investor earns when using leverage. It can also be called the return of the investor’s investment or equity in the portfolio.

On this page, we discuss the leveraged return formula and provide a leveraged return Excel template calculator to calculate the leveraged return.

Leveraged portfolio return formula

As long as the funds can be borrowed (denoted B) at rates below the return earned on the investments made (r_I > r_B), leverage will enhance portfolio return. Leverage also increases the exposure of the portfolio to interest rate risk. In particular, when interest rates increase above the return on portfolio assets (r_I < r_B). Borrowing is normally done at shorter-term interest rates. These rates can go up or down faster than return on assets. In other words, asset duration normally exceeds the liability duration in a leveraged portfolio.

The leveraged portfolio return formula is the following

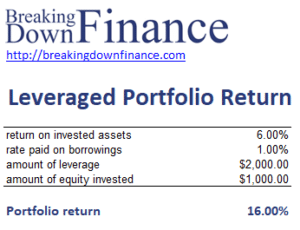

where r_p is the return on the portfolio, r_I is the return on invested assets, r_B is the rate paid on borrowings, V_B is the amount of leverage and V_E is the amount of equity invested. Next, let’s implement the formula.

Leveraged portfolio return example

A leveraged return template can be downloaded at the bottom of the page.

Risks of leveraged portfolios

There are also risks related to the use of leverage. On the one hand, there’s the obvious risk that if borrowing costs are higher than the earnings on the portfolio assets, losses are higher. Thus, there is the risk that interest rates rise or that investors are forced to sell because of margin calls (called fire sales), forcing leveraged investors to sell under distressed conditions.

Summary

We discussed how investors can increase portfolio return using leverage. Especially in periods of low interest rates, the use of leverage is attractive.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Leveraged Portfolio example