Strategic versus Tactical Asset Allocation

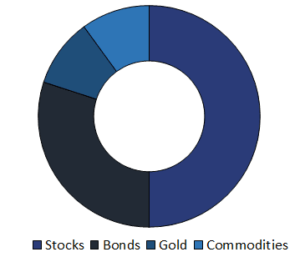

What is the difference between strategic versus tactical asset allocation? While both concepts are strongly related, there are nevertheless important differences. Strategic asset allocation refers to the long-term asset allocation. This is the allocation between stocks and bonds, or the allocation between stocks, bonds, and alternative investments. The tactical asset allocation is more short-term. Tactical asset allocation tries to take advantage of temporary dislocations in a opportunistic way.

On this page, we discuss the main strategic asset allocation models, tactical asset allocation models and how the two approaches are typically used together.

Strategic asset allocation

The strategic asset allocation portfolio choice for long-term investors deals with the allocation among different asset allocations based on long-term forecasts. In particular, long-term investors will typically estimate the equity risk premium over the next decade. Based on this information, they will then allocate between stocks and bonds. If the equity risk premium is expected to be high, a higher allocation to stocks is warranted.

Important is to understand that the strategic asset allocation is set first. Typically, it does not change for many years.

Tactical asset allocation

The tactical asset allocation is an overlay. Thus, investors will use both a strategic and a tactical asset allocation at the same time. The tactical asset allocation can change from month to month. Thus, it is far more short-term than the strategic asset allocation. Tactical asset allocation models can be based on momentum signals, mean-reversion signals, valuation signals and so on.

Tactical asset allocation models are active in nature and try to generate excess returns within and across asset classes by temporarily deviating from the strategic asset allocation. Thus, the tactical asset allocation reacts to changes in market conditions, whereas the strategic asset generally does not.

Strategic vs. tactical asset allocation

What is more important, the strategic or the tactical asset allocation? In general, most of the performance of a portfolio will be determined by the strategic asset allocation. In fact, the choice between stocks and bonds will have a very big impact on the eventual return. Tactical asset allocation will only have a minor impact.

Summary

We discussed the main characteristics as well as the differences between strategic and tactical asset allocation. The key takeaway is that both are generally used at the same time. The main difference is that they operate at different frequencies and that the tactical asset allocation is changed frequently over time.