Breakout strategy

Breakout trading is a very popular technical trading strategy, especially in foreign exchange (FX), but it is also used for stocks, futures, and other securities. On this page, we define breakout trading, provide two examples of a breakout, and explain what a false breakout looks like.

Definition breakout strategy

A breakout strategy creates a positive or negative trading signal when the price breaks out of a certain range of values.These range are often called resistance and support levels, and tehy defined using several ways. They can be based on past prices or other indicators.

Breakout strategy based on high and low prices

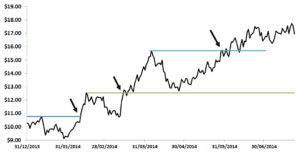

One way of defning the breakout levels, is simply using the high and low prices over a certain lookback period. The following figure illustrates how to use past low and high prices to define the resistance or support levels. In particular, there’s a buying signal when the price goes above the recent high price, and there’s a sell signal when the price goes below the low price (or support level). The figure below illustrates a number of resistance levels based on recent highs. The buying signals are indicated with arrows.

Using the above trading signal, we can enter the position in the case of a positive signal, and exit the position in the case of negative signal. The latter can be done using a trailing stop-loss order. This is a sell order that is increased as long as the price increases (i.e. it ‘trails’ the price). When the price drops, however, the stop-loss is not adjusted. Instead, it is triggered when the price drops below the stop loss price.

Breakout strategy based on moving averages

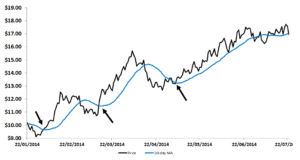

A second example of a breakout strategy is a strategy that uses moving average trading rules. In this case, there’s a breakout when the price crosses the moving average. In particular, when the moving average crosses the price series ‘from below’, we have a selling signal. When the moving average crosses the price series ‘from above’, we have a buy signal. The figure below indicates the breakouts using arrows.

Some other popular breakout strategies that we do not discuss here are the price volume breakout, open range breakout, and the london breakout strategy. We should note that in practice, most of these variations will produce very similar returns when applied to a range of securities simultaneously.

False breakout

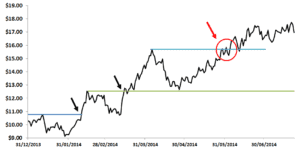

An important concept when executing breakout strategies is so-called false breakouts. A false breakout is breakout where the trend quickly reverses again. When this happens, we do don’t generate a profit and we are forced to close the position again. In this case, the breakout did not generate a profitable signal. The red circle indicates a false breakout.

Summary

We discussed the concept of breakout strategies. These strategies generate buy- and sell signals when the price rises above or drops below a certain value. These values can be based on moving averages, recent high and lows, or other indicators. Trading breakouts is a very popular strategy that is mostly used in FX.