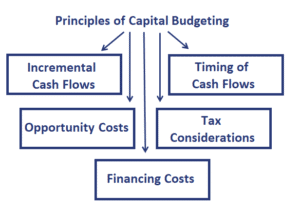

Principles of Capital Budgeting

The basic principles of capital budgeting, sometimes also called the basic principles of cash flow estimation, outline the most important do’s and don’t when assessing whether or not a project should be considered. There are five key principles that one should study by heart when working frequently on budgeting for projects.

On this page, we discuss the five basic principles for capital budgeting.

Incremental cash flows

The first principle is that decisions should be based on cash flows, not accounting income. Thus, when evaluating a project, we should only look at the incremental cash flows following from the project. It is important that sunk costs should not be taken into consideration. Externalities, such as the cannibalization of sales of existing projects, on the other hand have to be taken into consideration.

Opportunity costs

Opportunity costs are cash flows that the firm will lose when pursuing the project. These could be, for example, the cash flows that can be earned from assets the company already owns. These should be taken into consideration. An example is a piece of land that would be used for the project. The opportunity cost of using the land should be considered.

Timing of cash flows

The timing of cash flows is important. Since we consider the time value of money, we should discount all cash flows appropriately.

Tax considerations

The impact of taxes must be considered. We care about the after-tax cash flows. The company’s value will not increase by the amount of taxes we send to the government.

Financing Costs

Financing costs are reflected in the required rate of return. Thus, we don’t have to consider the financing costs separately. Riskier projects will have a higher required rate of return and should therefore generate higher cash flows.

Summary

We discussed the basic principles of cash flow estimation. There are 5 key principles that should always be considered.