Brinson Model

The Brinson model, also known as the Brinson Fachler model is a model that is used to perform performance attribution. It is commonly used by investors to assess the performance of fund managers. In particular, both Bloomberg and Morningstar use this methodology for performance attribution. The model was developed by Gary Brinson in 1986, although the model is sometimes also referred to as the Brinson Hood Beebower attribution method.

On this page, we discuss Brinson attribution analysis, discuss the Brinson Fachler model formulas and conclude with a numerical example in Excel.

Brinson attribution model

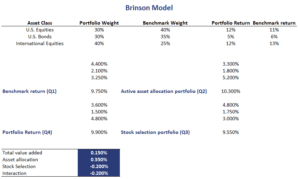

The Brinson method works as follows. The approach consists of constructing a number of notional portfolios. In particular, we need to construct 4 portfolios. Two of these portfolios are easy to obtain.The first one is the benchmark return (Q1)

where w is the weight of security j in the benchmark b, and r is the return of the security j in the benchmark. This portfolio uses benchmark sector weights and benchmark sector returns. The second portfolio is the fund itself. This portfolio uses portfolio sector returns and portfolio sector weights (Q4)

Next, there’s the two portfolios that measure active stock selection and active asset selection. The active asset selection portfolio (Q2) uses benchmark sector returns and portfolio sector weights

The stock selection portfolio (Q3) uses benchmark sector weights and portfolio sector returns

We can then calculate the components of a fund’s performance as follows

Brinson model example

Finally, let’s have a look at an example. The following spreadsheet implements the Brinson attribution model using some sample data.

The Brinson Fachler model Excel spreadsheet can be downloaded at the bottom of the page.

Summary

We discussed the Brinson Fachler attribution model. It is used extensively in the finance industry to analyze fund managers’ skill and whether or not they add value to the portfolio.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Brinson MBrinson Model exampleodel example