Tracking error

What is tracking error of a portfolio? The index fund tracking error (TE) is the extent to which the returns of the fund do no match the returns of the benchmark that the portfolio manager is trying to replicate. Managing the portfolio tracking error at the lowest possible cost is one of the most important considerations of ETF providers. On this page we provide the tracking error formula, show how to perform a tracking error calculation, discuss ex ante tracking error and ex post tracking error, At the bottom of this page, we provide an Excel example that implements the approach.

Tracking error formula

The way to calculate tracking error is to compare the fund returns with the benchmark returns in the following way. In particular, every day (or week, or month) we compare the performance of the fund with that of the benchmark that is being tracked. The difference is squared, since otherwise negative and positive difference would cancel each other out. The full formula looks as follows:

Where Rp is the return of the manager of the fund, Rb is the return of the benchmark, and N is the number of return periods. Clearly, the TE is nothing more than the standard deviation of the difference between the fund manager’s returns and the returns of the benchmark. So basically, the TE is actually a kind of volatility around the benchmark’s returns.

The resulting TE will be a daily, weekly, or monthly figure. If we want to have the annual TE we take the obtained number and annualize it, to obtain the annualized tracking error. It is clear from the formula that a negative tracking error is not possible, since we first take an even power and then the square root.

The obtained TE is sometimes also referred to as the active return. The TE we have just calculated is the ex post tracking error. This is different from the so-called ex ante tracking error, which is the amount of TE that the manager allows when running the portfolio. Since it is almost impossible to have a TE of zero, managers will try to minimize it. A small level of TE is not necessarily a bad thing, since it may be too costly to avoid it.

Tracking error interpretation

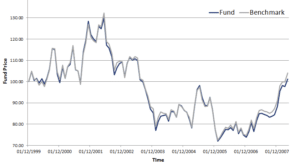

The interpretation of tracking risk is straightforward. The higher the TE, the larger the deviations between the manager’s portfolio returns and the returns of the benchmark the manager is expected to replicate. Depending on the manager’s mandate, a high TE may be allowed in which case it is not a problem.

Clearly, a manager that tries to track an index will be subject to tracking risk. Tracking risk is the risk that his fund deviates too much from the index he or she is trying to track. Proper risk management will try to manage this risk. Managing the ETF tracking error is often done using derivatives to ensure that new money inflows do not generate a TE.

Tracking error example

In the Excel file below we implement the above formula using a simple example where we compare a sample of monthly returns of a manager with the performance of the benchmark. The formula can easily be implemented in Excel.

Summary

We discussed the tracking error (TE) of a portfolio. It is a very important consideration for investors that wish to track the performance of a benchmark. In practice, the TE will almost never be zero, because of real-life frictions such as transaction costs.

Implementation

Want to have an implementation in Excel? Download the Excel file: Excel file.