De-smoothing returns

Analysts may sometimes want to de-smooth returns. This is necessary when dealing with certain hedge fund categories. More illiquid hedge fund categories, such as fixed-income arbitrage and emerging markets hedge funds’ returns may be too smooth. This happens when hedge funds deliberately report returns in a way that makes them more attractive for investors. That is, less volatile. The same effect is sometimes at play in private equity and real estate indices.

On this page, we discuss why it is important to correct returns when they are too smooth and how to de-smooth returns using an Excel spreadsheet.

Causes return smoothing

Return smoothing is done deliberately by private equity and hedge funds. The aim is to make the returns of their funds look more attractive than it actually is. Because such funds have some leeway in reporting their profits, they can spread gains and losses over time. To see this, let’s consider a hedge fund that invests in illiquid assets. Because there is no market for the security, the hedge fund can value the positions mark-to-model.

If certain assets dropped a lot in value, the hedge fund may be tempted to spread the loss over several periods rather than reporting a big loss at once. Similarly, good performance can be spread over multiple month to cover losses in other positions in the future.

Return smoothing consequences

The consequence of this kind of behavior by funds is that their returns are positively serially correlated. That’s because losses and gains are spread over time. Smoothing returns has the advantage that it makes performance look better than it actually is. Why? First, it lowers the volatility of the returns, making them look less risky. Second, it can help avoid reporting negative returns. Instead, a big return in one month as well as losses in a subsequent month can be reported as two positive months. The overall result of smoothing is higher Sharpe ratios and too low volatility of the returns.

De-smoothing returns

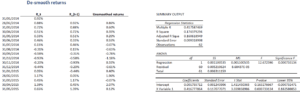

While there are several methods to de-smooth return, we will cover a simple method that uses an AR(1)-model to de-smooth returns. In particular, if we have a set of returns, we estimate the following equation:

Once we have estimated the above AR(1)-model, we can use the parameter ⍴1 to de-smooth the returns as follows

The following table illustrates the basic process. The spreadsheet implementing the approach can be downloaded at the bottom of the page.

De-smooth hedge fund returns

Want to have an implementation in Excel? Download the Excel file: De-smooth Returns

Summary

We discussed the process of de-smoothing the returns of hedge funds and private equity funds. Using a simple AR(1)-model in Excel, we can easily adjust the returns of such funds.