Butterfly Trades

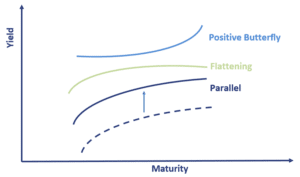

Butterfly trades with bonds are a leveraged way to capture value when the yield curve’s curvature changes. These trades involve taking a long and an offsetting short position in a bullet and a barbell, respectively. The short position funds the long position so no investor capital is required. The long and short duration cancel each other for a 0 net duration. Hence, butterfly trades are so-called duration-neutral curve trades. Butterfly trades profit primarily from change in curvature.

On this page, we discuss two kinds of butterfly trades with bonds: the super barbell and the super bullet. What is key to remember is that butterfly trades have zero net duration. Thus, these trades are duration neutral.

Super barbell

A butterfly portfolio shorting intermediate-term bonds (borrowing at intermediate rates) and investing the proceeds in the barbell portfolio is called a super barbell. This can be called short the body (intermediate) and long the wings (barbell):

- it profits from increasing curvature

- it also has net positive convexity and profits from high volatility. recall the barbell with more disperse cash flow will have greater convexity than the concentrated cash flow short bullet position. Thus, long the barbell convexity less short the bullet convexity will be net positive convexity.

Super bullet

A butterfly portfolio shorting the barbell portfolio (borrowing at a combination of shorter and longer rates) and investing the proceeds in intermediate-term bonds is called a super bullet. This can be called short the wings and long the body:

- it profits from decreasing curvature

- it also has net negative convexity and profits from having higher yield.

Condor trades

Finally, we highlight the fact that condor trades work in the same way as butterfly trades. The only modification is that two positions with relatively close duration are used for the bullet.

Summary

We discussed how to create a zero net duration bond portfolio that can be used to create portfolios that have positive (super barbell) or negative convexity (super bullet). Duration-neutral curve trades are designed to benefit from changes in the curvature of the yield curve.