Cash flow matching

Cash flow matching is a method used by fund managers to replicate a fixed income instrument or an index portfolio of fixed income securities. The objective of cash flow matching is to match the present value distribution of cash flows of the index.

On this page, we explain how cash flow matching works using a simple numerical example. The spreadsheet used to create the example is available for download at the bottom of this page.

Cash flow matching explained

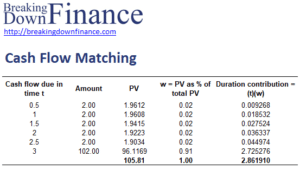

We will use a simple example to demonstrate cash flow matching and its relationship to bond price, duration, and key rate durations. They are all interrelated. In the example we use is for a 4% semiannual pay three-year bond trading at par (4% YTM) that we want to replicate:

Based on this data, matching the bond works as follows:

- We list the cash flows by six-month period (t) of the security. If there are embedded options included in the index, the estimates we use should be based on the best estimates of the amount and when the cash flow will be received.

- The bond’s price is the discounted present value of its future cash flows using a 4%/2 semiannual period discount rate.

- Each weight w in the table is computed as that present value as a percentage of total PV (the price).

- each (t)(w) is the cash flow’s contribution to duration and a key rate duration. The sum of the duration contributions (key rates) is the bond’s (or index its) duration.

Now, the objective is to match the w of the replicating portfolio with that of the bond (or index) we wish to replicate. This will automatically match their (t)(w). This matching of present value distribution of cash flows is also matching the duration contribution and key rate durations. These actions minimize exposure risk from changes in shape of the yield curve. This approach also matches total duration and convexity between the replicating portfolio and the bond (or index).

The goal of matching all the risk factors is to minimize tracking error while avoiding the expense of full replication.

Summary

We discussed matching the present value of cash flows as a method to replicate an index. In practice, managers will use other approaches that are somewhat more flexible, such as stratified sampling.