Excess Return to Credit Risk

The excess return to credit risk (XR) is a spread measure used to estimate the expected excess return on credit risk bonds over a default-free government bond. Spread widening (narrowing) will lead to reduced (increased) performance due to relative price decline (increase) by the credit risky spread asset.

On this page, we discuss the credit risk excess return formula and implement the approach using a numerical example. A spreadsheet used to implement the numerical example is available for download at the bottom of this page.

Excess return to credit spread formula

If the credit spread is not expected to change over the investment horizon, then the excess return (XR) is approximately the spread (s) earned over the projected time period (t). Spread widening will lead to reduced performance and spread narrowing will lead to increased performance. Thus, we add the expected change in the spread times the spread duration (SD) of the security.

![]()

When default loss estimates are included, then the result is typically referred to as the estimated excess return (EXR) to credit risk.

where p is the probability of default and L is the loss given default or loss severity (one minus the recovery rate).

Excess return to credit risk example

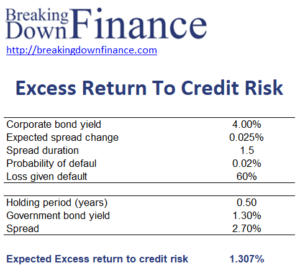

Let’s consider a numerical example that applies the above concepts. The following table illustrates how we can use the above formulas to calculate XR and EXR. The spreadsheet used to create the example is available below.

Summary

The credit spread can be viewed as the incremental return above the benchmark. Using the excess return to credit risk, we can forecast the expected return on a credit risky security that considers forecasts of spread widening or narrowing and expected losses on the bond.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Excess Return To Credit Risk example