Upfront Premium CDS

The upfront premium for a credit default swap (CDS) is equal to the difference between the present value of the premium leg and the present value of the protection leg. The premium leg is the payments made by the protection buyer to the protection seller. The protection leg is equal to the contingent payments the protection seller must pay in case of a default.

On this page, we discuss how an investor can approximate the upfront premium using the CDS spread and the CDS coupon rate. We also discuss a CDS premium example in Excel. The CDS premium calculator is available for Excel at the bottom of the page.

Upfront Premium CDS formula

In general terms, the upfront premium equals

where the upfront payment is typically paid by the protection buyer (although it depends on the bond being insured). To approximate the upfront payment, we can use the CDS spread and the CDS coupon rate. In particular, the upfront premium equals

The CDS price can also be inferred from the upfront premium. It will be approximately equal to

Also, the CDS spread can be approximated by rewriting the second formula.

Upfront Premium CDS example

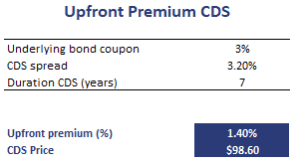

Let’s illustrate the approach using a simple example. The following table calculates the CDS price and the CDS upfront premium %. It is clear that the calculation of the upfront premium can easily be approximated using the formulas provided above.

The spreadsheet used to create this example is available for download at the bottom of the page.

Summary

We discussed how to approximate the upfront premium for a credit default swap using the CDS spread and the CDS coupon rate. Once we have the upfront premium (%), we can also approximate the CDS price.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: CDS premium template