PRAT Model

The PRAT model is widely used by financial analysts to calculate a company’s sustainable growth rate. The sustainable growth rate (SGR) is the rate at which the earnings (and dividends) of a company can continue to grow under the assumption that the (1) company’s debt-to-equity ratio does not change and (2) the company does not raise additional equity. The PRAT model is related to the DuPont formula and is actually an acronym for:

- P: Profit Margin

- R: Retention Rate

- A: Asset Turnover

- T: Financial Leverage

On this page, we discuss the discuss the relationship between the sustainable growth rate and the DuPont formula. Next, we discuss the PRAT model formula. Finally implement an example in Excel. The Excel template is included at the bottom of the page.

PRAT model formula

First, let’s look at the formula used to estimate the sustainable growth rate using the DuPont formula. We first start from the following relationship between return on equity (ROE) and the sustainable growth rate g.

Now, we know that ROE can be decomposed using the DuPont formula as follows:

finally, we can combine both formulas. Thus, g can be calculated as:

This is the PRAT formula, which shows that the sustainable growth rate is a function of the profit margin (P), the retention rate (R), the asset turnover (A), and financial leverage (T).

PRAT model interpretation

The PRAT model tells us that that a firm’s growth rate depends on two kinds of factors:

- On the one hand, a company makes certain financing decisions (leverage and earnings retention)

- On the other hand, there’s the company’s performance (profit margin and asset turnover)

If the actual growth forecasted by an analyst is greater than the sustainable growth rate, then this implies that the company will have to issue more equity, unless the firm increases its leverage, profit margin, total asset turnover, or retention rate.

PRAT example

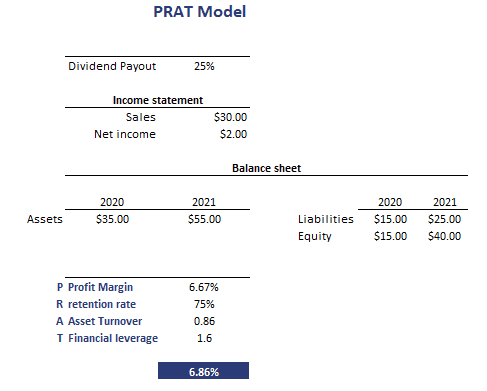

To make things a bit more concrete, let’s apply the formula to some actual sample data. The figure below illustrates how we can combine data on the different components of the model to estimate a company’s sustainable growth rate.

Summary

We discussed the PRAT model. The method can be used to calculate the sustainable growth rate (SGR). The advantage of the PRAT model is that it provides the analyst clear insight on the drivers of the sustainable growth rate.

PRAT

Want to download the Excel template? PRAT formula