5 Stages Of Venture Capital Financing

Venture capital financing typically involves several stages of funding, each of which serves a different purpose and carries different terms and conditions. Here we discuss the 5 stages of venture capital financing that a startup typically goes through. Some of these stages may go under different names.

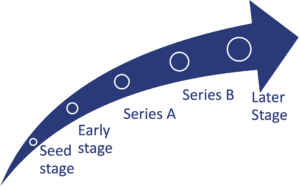

Venture capital stages

The five stages of venture capital financing are:

- Seed stage: This is the first stage of financing that a startup receives. The money is used to fund the initial development of a product or service and is usually provided by angel investors or seed-stage venture capital firms. Seed stage financing is typically small in size compared to later rounds of financing. Seed stage funding is most of the time accompanied by a convertible note, which gives the investor the option to convert the debt into equity at a later date.

- Early stage: Early stage financing is the second round of funding that a startup receives, typically after the seed stage. It is sometimes also referred to as the startup stage. Early stage cash is used to fund the growth of the business and can be provided by angel investors or early-stage venture capital firms. This kind of financing is typically larger in size compared to seed stage financing and it is often accompanied by a more detailed equity investment agreement.

- Series A: Series A financing is the first round of institutional venture capital financing that a startup receives. That’s why some also refer to it as the first stage. The capital is used to fund the expansion of the business and is typically provided by venture capital firms. Here too, the investment is typically accompanied by a more detailed equity investment agreement.

- Series B: Series B financing is the next round of institutional venture capital financing that a startup receives, typically after the Series A round.This is the expansion stage. In this case, the cash is used to fund the growth and expansion of the business and is also typically provided by venture capital firms. Series B financing is typically higher than the funding in the earlier stages.

- Later stage: Later stage financing is any round of venture capital financing that takes place after the Series B round. The bridge stage is used to fund the expansion of the business and may be provided by venture capital firms or strategic investors. Here the biggest amounts of investment are involved.

Summary

The 5 stages of venture capital financing we describe above are not always strictly defined. The number of stages and the size of the stage will also heavily depend on the specific circumstances of the startup.

Some startups may actually skip some of the stages of financing, while others will go through multiple rounds of financing within a single stage if it takes longer to successfully take a step in the development of the product or service.