Accrual Tax Formula

Accrual taxation is a periodic (usually annual) tax at a single tax rate on income or return. It is the most common type of taxation and it is applied by most countries to tax dividends and interest. On this page, we discuss the accrual taxation formula and discuss a number of generalisations. A spreadsheet that implements the formula is available at the bottom of the page.

Other kinds of taxation included deferred capital gains taxation and blended taxation. More details on these alternative taxation methods can be found on the pages dedicated to those kinds of taxation. Here we focus on accrual taxes and the accrual tax formula.

Accrual taxation formula

The future value of an investment after-tax under accrual taxation is:

where r is the pre-tax return, ti is the accrual tax rate and n is the number of periods (in years). Notice how r(1-ti) is the after-tax rate of return so the computation is simply the after-tax value of a single initial currency unit invested. While the computation is simple, the ultimate effect of taxes on future value depends on a number of parameters. The best way to quantify the tax effects is by calculating the tax drag.

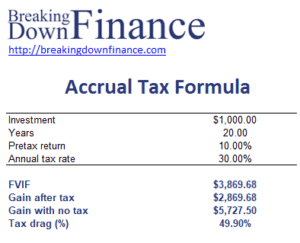

Accrual tax example

Let’s consider a simple accrual taxation example, where we also calculate the tax drag. The spreadsheet is available for download at the bottom of this page.

Accrual tax characteristics

There are number of generalisations we can make about accrual taxes:

- Over a time horizon of more than one year, the tax drag percentage exceeds the tax rate because the periodic payment of taxes reduces the benefits of tax-free compounding over time

- The adverse effects increase as the time horizon increases

- The adverse effects increase at higher rates of return as the dollar amount consumed by taxes is higher each year

- The time horizon and level of return effects compound, meaning tax drag is further when both time horizon and rates of return are longer and higher.

Summary

We discussed the simplest type of taxation, accrual taxation. It is commonly used to tax dividends and interest income.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Accrual Tax Formula Example