Annual Wealth Tax Formula

An annual wealth tax is a tax that is imposed on the total value of a portfolio and not just the return of the portfolio. Many countries impose annual wealth taxes on the value of real estate, often called a property tax. Estate taxes and gift taxes work similarly, although the tax is only imposed once at death or at the time of the gift, not annually.

On this page, we discuss the annual wealth tax formula as well as a number of stylised facts related to annual wealth taxes. An Excel spreadsheet that implements the formula is available at the bottom of this page.

Annual wealth tax formula

The future value of an investment (FVIF) after tax under wealth taxation can be calculated as follows:

where r is the pre-tax return, tw is the wealth tax, and n is the number of periods (in years). Notice how the tax applies to the full period value (1+r) and not just the return r. This explains why a wealth tax is much larger than any other form of taxation because it applies to both the starting value and the return earned.

Annual wealth tax example

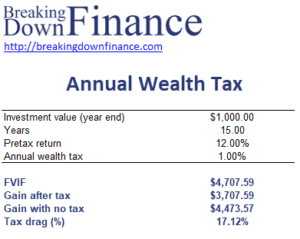

The table below illustrates the application of wealth tax formula. The spreadsheet used to create this simple example can be downloaded at the bottom of the page.

Wealth tax characteristics

A wealth tax has a number of characteristics which we briefly discuss here. The spreadsheet at the bottom of the page allows you to simulate some of these cases.

- wealth taxes are much more onerous than other taxes because they apply to total value, not just return.

- The adverse effects increase as the time horizon increases. Both the tax drag amount and percentage increase due to the loss of pre tax compounding.

- At higher rates of return, the tax drag percentage declines even as the dollar amount increases

Summary

We discussed the way in which taxes on wealth impact after tax returns. These effects are more onerous than under accrual taxation or deferred (capital gains) taxation.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Annual Wealth Tax Formula Example