Capital Rationing

Capital Rationing describes the approach that companies apply when they don’t have enough capital to invest in all projects that will have a positive return. In theory, companies should invest in positive return net present value (NPV) projects as long as the marginal return is equal or larger than the marginal cost of capital (MR=MC).

If there is not enough capital, then the company will need to ration it. That is, the company will need to allocate its resources among the best possible combination of acceptable projects. This, in a nutshell, is how equity rationing works. It is the allocation of a certain amount of capital among the set of available projects that will maximize shareholder wealth.

On this page, we discuss how rationing works in practice using a numerical example that we implement using Microsoft Excel. We also discuss the difference between hard rationing and soft rationing.

Rationing implications

A company that doesn’t have enough funds to execute all profitable (i.e., positieve NPV) projects should go for the combination of projects it can afford to fund and that has the greatest total NPV. While this maximizes shareholder wealth using the available capital, more value would have been created by investing had the company been able to invest in all positive NPV projects. Said differently, rationing capital violates market efficiency. That’s because at the level of the society, resources are not allocated to their best use.

Hard versus soft capital rationing

Hard rationing occurs when there is no way to raise more capital. The capital budget cannot be increased in any way. Soft rationing occurs when departments within a company are able to increase their allocated capital budget if they can justify to company management that the additional resources will create shareholder value.

Capital rationing example

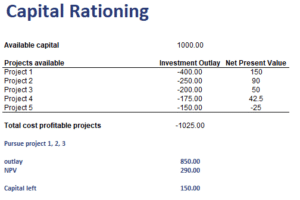

Next, let’s consider an example of a company that has a budget that can be invested into five projects. The initial investment as well as the net present values (NPV) for each project are reported in the following table:

Note that the goal with rationing capital is to maximize the overall NPV within the capital budget, not necessarily to select the individual projects with the highest NPV.

Summary

Summary, we discussed rationing capital, the difference between hard vs soft rationing and a rationing example in Excel.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Capital Rationing Example