Core capital

Core capital is the amount of assets that is necessary to meet all the individual’s liabilities plus a reserve for unexpected needs. Core capital can be calculated using mortality tables. Mortality tables show an individual’s expected remaining years based upon attaining a given age.

On this page, we illustrate how core capital can be estimated using survival probabilities and real annual spending. A spreadsheet that implements the necessary routines is available at the bottom of the page.

Core capital formula

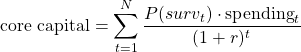

Let’s start with discussing the formula needed to calculate core capital:

where r is the real risk-free rate. Thus, to perform the calculation we need the survival probabilities, real annual spending and the risk-free rate to discount future spending back to today. The fact we use the risk-free rate to discount back to today reflects the importance of meeting the spending needs.

In case we need to estimate the capital for a couple, we first need to calculate the joint probability of survival. This can be done using the survival probabilities of the husband and the wife:

Example

The following table shows what the calculation would look like based on actual mortality probabilities plus information on real annual spending for an individual. The final column is a running total. This is the amount of capital required to meet living expenses through the given year.

The spreadsheet that implements this particular example is available for download at the bottom of the page.

Summary

We discussed how to calculate the capital needed to cover expenses in retirement. It is important to stress that it should include a safety reserve. If not, there is a 50% chance that the individual will outlive the capital. Additionally, there is also considerable path dependency risk. If spending needs occur early on or returns are low in the early phase, the portfolio may not recover.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Core Capital example