Types of Real Options

Real options in capital budgeting allow a company’s management to make future decisions that may change the value of capital budgeting decisions made today. While there are several types of real options, all of them always increase the present value of a project. That’s because they offer increased flexibility. Thus, when in doubt, know that a real option’s value is always positive. Real options analysis is most appropriate when the company’s management is able to make decision on the project in the future.

On this page, we discuss the most common types of real options. In particular, we discuss 5 types of real options. These options provide management flexibility which enables them to improve the NPV for individual projects.

Types of real options

What are real options? Let’s go over the five examples of real options in capital budgeting:

- Timing options: allow the company to delay making an investment. If new information is available by the time the decision should be taken, the company can make a more informed choice

- Abandonment options: allow the company to abandon a project if the present value of the incremental cash flows from exiting exceed the incremental cash flows from continuing with the project. This is similar to a put option

- Fundamental options: these options are a special case in which the projects themselves are the options. An example is a mine. Mining the raw resource or not is the flexibility the company has

- Expansion options: these options are similar to call options. The company can make additional investments if the project proves successful

- Flexibility options: these are options related to the operational aspects of a project. there are two kinds of flexibility options: price-setting options and production-flexibility options. In the first case, the company can change the price, in the second case the company can change the amount it produces

Project evaluation with real options

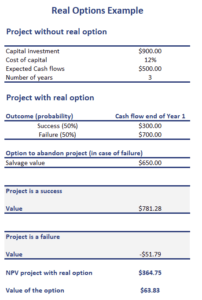

When performing project valuation using real options, we should follow a three-step approach. First, we value the project without the option. Next, we value the project assuming the option is exercised. Finally, we subtract the value of the project without the option from the value of the project with the option to determine the value of the real option.

Real option valuation example

Let’s discuss a real option analysis example. The following real option excel, which is available for download at the bottom of the page, shows how to calculate the value of a real options

Summary

We discussed the real options theory. Real options give management the flexibility to change the way in which a project is executed or to abandon it altogether if the project is no longer attractive.

Download the Excel spreadsheet

Want to have an implementation in Excel? Download the Excel file: Real Options example